Economist James L. Pierce, authority on banking and monetary policy, dies

| 25 February 2009

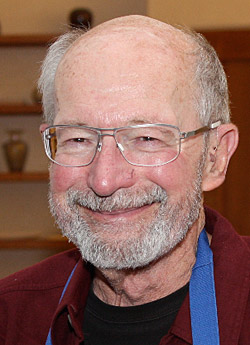

BERKELEY — James L. Pierce, a professor emeritus of economics at the University of California, Berkeley, and an authority on banking and monetary policy, died of lung disease in Alta Bates Hospital in Berkeley, Calif., on Feb. 15. He was 71.

James Pierce (Jon Pierce photo)

James Pierce (Jon Pierce photo) "His major contribution was in applied monetary policy, both writing about it and shaping it," said Roger Craine, a UC Berkeley professor of economics who worked for Pierce at the Federal Reserve before they reconnected later on campus. "He cared about economic policy and was always involved in it."

At the time of a banking upheaval in the 1980s, Pierce argued that banks needed to have more capital to handle increasing risk. "The capital I think they had in the past was appropriate for a world that was much more stable than the one we have now," Pierce said in a San Francisco Business Journal interview in 1984, describing a financial world much like the current one.

Born in Berkeley, Calif., on Sept. 24, 1937, Pierce grew up in the San Joaquin Valley farming town of Dos Palos, Calif., where his father had a car dealer partnership. He attended UC Berkeley and received a B.A. and Ph.D. in economics there in 1959 and 1964, respectively.

Pierce joined the economics faculty at Yale University in 1963 and was a member there of the Cowles Foundation for Research in Economics. He left Yale to accept a position with the board of governors of the Federal Reserve System from 1966 to 1975, serving as associate director in the division of research and statistics and as an associate economist with the Federal Open Market Committee.

After leaving the central banking system in 1975, he spent a year directing the Financial Institutions and Nation's Economy (FINE) study for the U.S. House of Representatives Banking Committee. The report was mildly controversial, Craine recalled, "because Pierce never pulled any punches."

Pierce contended that the 1980s Savings and Loan Crisis was a minor problem that escalated into a major fiasco due to policy errors that he and others noted and tried unsuccessfully to change - such as deregulation of the asset side of the savings and loan banks that cleared the way for loans of any kind while keeping liability limits that minimized the impact of the savings and loans' bad business practices.

In 1976, Pierce returned to UC Berkeley as a professor of economics. He taught graduate and undergraduate courses in macroeconomics, monetary and financial economics, and economic policy, and also taught the principles of economics to beginning undergraduates.

His publications included the book "The Future of Banking" (1991) and "Origins and Causes of the S&L (Savings & Loan) Debacle: A Blueprint for Reform" (1993), written for the National Commission of Financial Institution Reform, Recovery and Enforcement, where he served as executive director. He also contributed a chapter about integrating banking with other financial services to a 1988 book, "Regulating the New Financial Services Industry."

In another book, "Bank Management and Portfolio Behavior" (1973), he and co-author Donald Hester of Yale presented the first econometric analysis of commercial bank and mutual savings bank behavior based on individual bank data.

He is survived by Suzanne Pierce of Berkeley, his wife of 18 years, and children Jonathan Pierce of Lafayette, Calif., Susan Pierce of Rancho Palos Verdes, Calif., and Sam Pierce of Berkeley. He is also survived by his sister Carol DelaCruz of Benicia, two nephews and three grandchildren.

Pierce was a voracious reader, enjoyed cooking and loved to visit the Northern California coastal community of Mendocino. Before his death, he had been writing a computer program for an interactive tutorial in economics that he envisioned could be easily used for other topics as well.

Former colleague Jim Friedman recalled that in the summer of 1966, he, Pierce and Don Hester - all then assistant professors of economics at Yale - traveled to Jackson, Miss., having been recruited by the civil rights activist and Yale chaplain William Sloan Coffin Jr.

"We thought instead of just going to register voters, we should use our expertise in economics in some especially helpful way," recalled Friedman. "Our notion was that black businessmen in the South probably had no access to banks for credit and that, if black businessmen in a community could band together and form a bank, then that bank could be a source of financial support."

The men were given lodging at a Tougaloo College dormitory and met with some "friendly, kind and somewhat skeptical" black businessmen and offered to help them set up a bank. A few days into their trip, news broke of the slaying of the young civil rights workers James Chaney, Andrew Goodman and Michael Schwerner. After a week in Jackson, the economists went home and later met with the U.S. comptroller of the currency. Friedman said their plans apparently didn't come to fruition.

There will be no memorial service for Pierce. Friends may donate in his name to the organization of their choice.