Berkeleyan

Sustainability 101

Why the Hewlett gift holds the key to Berkeley's future

![]()

| 12 September 2007

Berkeley is not only America's leading public university, it's one of the nation's elite institutions of higher learning. Berkeley, however, stands alone among its peers in its commitment to making a world-class education available to the state's most promising students, without regard to family income or multi-generational alumni ties.

From the standpoints of competitiveness and sustainability, therein lies the rub.

"The fact that we're a public university and the fact that we have these twin pillars of access and excellence make things very, very challenging for us financially," explains Nathan Brostrom, Berkeley's vice chancellor for administration. "This is something we hold very dear, the combination of high-quality education and making that accessible to all Californians, not just the wealthiest, or those that have some 'in' to higher education."

During the 2004-05 academic year, more than one-third of Berkeley's 22,800 undergrads received federal Pell grants, financial aid provided to students with family incomes below $45,000. Pell recipients at Stanford, by contrast, accounted for just 14 percent of all undergrads, while only eight in 100 received the grants at Yale and Harvard.

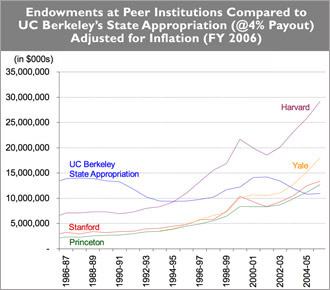

This graphic (click for larger version) shows the remarkable growth in endowment assets enjoyed by four of the elite private universities with which Berkeley competes for the most accomplished faculty and students. The line for Berkeley represents the hypothetical endowment required to yield the equivalent of its state appropriation. (Source: Office of the Vice Chancellor for Administration) |

And unlike Berkeley - which depends on the state of California for nearly a third of its funding - Stanford, Yale, Harvard, and other elite universities rely entirely on private philanthropy to keep their coffers not just full, but constantly growing. The yearly payout on Harvard's endowment alone - conservatively calculated as a 4 percent return on about $30 billion - could pay for Berkeley's entire operating budget. In practice, annual returns on university endowments can be as high as 20 percent.

"One way we differ from our private peers is that they raise much more in endowments, and we raise much more in current gifts," Brostrom says. "And we'd like to shift that, because endowment really is critical to long-term sustainability."

The Hewlett Foundation gift, which establishes 100 new endowed chairs, points the way to Berkeley's financial future.

The math is simple, says Brostrom, the campus's chief administrative and financial officer and a widely respected public-finance banker before coming to Berkeley last year.

"Let's say you have a million dollars," he explains. "You keep it in the endowment, it earns 10 percent every year. Of that million dollars, you have a 4.5 to 5 percent payout," or the amount of return on investment allotted for spending. (The rest goes back into the endowment.) "At the end of the year you'd have a $1.05 million endowment, and you'd have $50,000 to use for your campus activities."

Until the mid-1990s, Berkeley's annual share of state higher-education funding - roughly equal to the payout from an $11 billion endowment - gave the campus a "huge competitive advantage" over its peer institutions, none of which had endowments that large. Today, even when adding in Berkeley's actual endowment of about $2.5 billion, that advantage has slipped away. And the gap is growing.

"Right now we can still compete," Brostrom says. "We have the resources, and we have committed faculty. We're in a solid financial situation, but one that's not sustainable. And the reason I think it's not sustainable is that if you extrapolated this out another 10 years, our state funding, even in the best years, is going to grow at 3, 4, 5 percent. Our competitors are all growing at double-digit rates."

Remaining competitive, however, has come at a cost. "One of the ways that we've been maintaining our competitive position is by basically cannibalizing our faculty lines," says Brostrom. "Our faculty are paid less than they would be if they were at Harvard or Stanford. But often, even just maintaining the gap of 10 to 20 percent, we've had to eat into faculty lines for new faculty in order to pay existing faculty more to retain them."

And the competition for top faculty is only growing more cutthroat, as better-heeled private universities dangle higher salaries, bigger and better labs, and other high-priced perks.

"We don't have a lot of greedy professors here," observes Brostrom, explaining the campus's strong track record in retaining faculty. "They're willing to stay and accept salaries that are substantially lower than they could get with an outside offer. They really do value public education, they value their colleagues and the team work environment, and they benefit from the comprehensive excellence of Berkeley."

At the same time, he adds, "The competition is relentless. Because it's not only about their salaries. It's also about their facilities, their graduate-student support, the whole list. And a lot of those have bigger price tags than just meeting their salaries."

Brostrom foresees a shift in the campus's approach to budgeting over the next 30 years, from so-called current gifts - whereby donors typically earmark funds for specific projects - to less-restrictive endowment payouts and improved management of campus assets, including the use of tax-exempt debt and improved investment strategies.

For the moment, though, the Hewlett gift provides a useful model for how to achieve long-term sustainability. At its heart, says Brostrom, is the concept of fungibility - the interchangeable nature of certain commodities, including money, that allows them to be substituted for each other.

When the threshold to endow a chair at Berkeley was $500,000, for example, "that would spin off $25,000 every year," he says - enough to pay for research funding a professor would otherwise have had to procure from outside the campus, but not enough to free up any campus resources for computer security, deferred capital maintenance, and other critical needs that lack donor appeal.

Now, with the threshold for an endowed chair raised to $2 million, funds for every such chair will spin off an estimated $100,000. Of that yearly payout, $25,000 will still support the professor's research. But another $50,000 will go to salary enhancement, while the remaining $25,000 will go to grad-student support within that department - money that formerly came out of the department's operating budget.

"The key is not only increasing the level of private philanthropy," Brostrom says, "but also increasing fungibility, so that the chancellor can allocate these funds to the top priorities and to the common good."

As for oft-expressed concerns that a great public university is turning increasingly to the private sector for support, Brostrom notes that the Hewlett Foundation "gave this to us because we're a public university," and in a non-directed form that allows the campus to pursue "comprehensive excellence."

"This is a great model, because the state will continue to be a strong and consistent supporter - it's just not able to fund the margin of excellence that we need in this competition," he says. "That's where private philanthropy can come into play....If you only had targeted gifts that were driven by donor interests, I think that's when you would be concerned about private philanthropy. This is so broad-based and unrestrictive, I think it's exactly the type of gift that we want to try to replicate."

The Hewlett gift also includes $3 million expressly for the purpose of enabling the campus to enhance its investment management. "Hewlett sees us at a point, and I would agree with them, where we have enough capacity that we should be doing more of our management in-house," Brostrom says. "And that $3 million was really a jump-start to help us figure out both the organization of that operation and, hopefully, to hire someone to come in-house. It was a very thoughtful addition and one, frankly, we hadn't really solicited."

By setting the campus further along the road to endowment-based budgeting, the $113 million Hewlett gift could be viewed as a jump-start to long-term financial sustainability - and the key to keeping up with better-funded elites while continuing to offer Berkeley's unique combination of access and excellence.